- Análisis

- Análisis Técnico

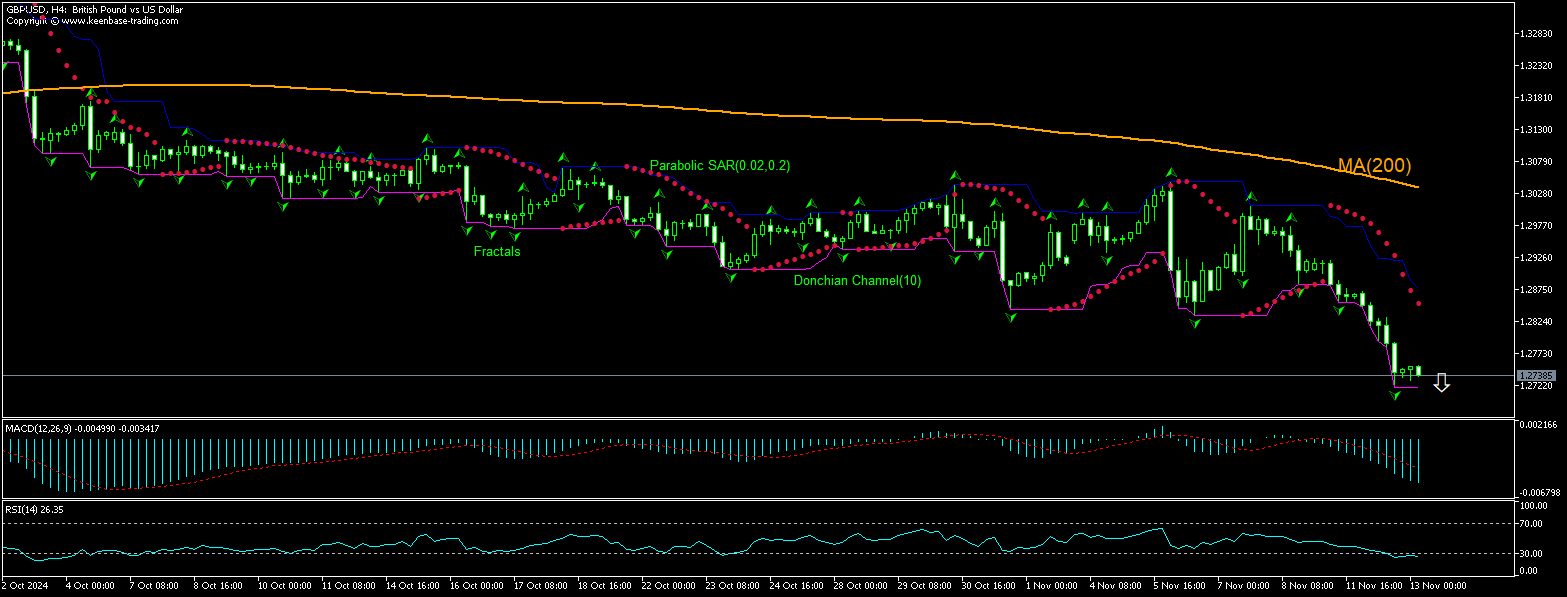

GBP/USD Análisis Técnico - GBP/USD Trading: 2024-11-13

GBP/USD Resumen de análisis técnico

Por debajo de 1.27182

Sell Stop

Por encima de 1.28522

Stop Loss

| Indicador | Señal |

| RSI | Comprar |

| MACD | Vender |

| Donchian Channel | Vender |

| MA(200) | Vender |

| Fractals | Vender |

| Parabolic SAR | Vender |

GBP/USD Análisis gráfico

GBP/USD Análisis técnico

El análisis técnico del precio del GBPUSD en el gráfico de 4 horas muestra que GBPUSD,H4 está retrocediendo por debajo de la media móvil de 200 periodos MA(200) que está bajando. El RSI se encuentra en zona de sobreventa. Creemos que el impulso bajista continuará después de que el precio rompa por debajo del límite inferior del canal de Donchian en 1,27181. Un nivel por debajo de este puede ser utilizado como punto de entrada para colocar una orden pendiente de venta. El stop loss puede situarse por encima de 1,28522. Después de realizar la orden, el stop loss se debe mover al siguiente indicador fractal alto, siguiendo las señales parabólicas. De esta forma, cambiamos la relación beneficio/pérdida esperada al punto de equilibrio. Si el precio alcanza el nivel de stop loss sin alcanzar la orden, recomendamos cancelar la orden: el mercado ha sufrido cambios internos que no se han tenido en cuenta.

Análisis fundamental de Forex - GBP/USD

El número de personas que solicitaron prestaciones por desempleo en el Reino Unido aumentó menos de lo esperado en octubre. ¿Se revertirá el retroceso del precio del GBPUSD?

El número de personas que solicitaron prestaciones por desempleo en el Reino Unido aumentó menos de lo esperado en octubre: la Oficina de Estadísticas Nacionales del Reino Unido informó el cambio de solicitantes: el cambio en el número de personas que solicitaron prestaciones por desempleo durante el mes anterior aumentó en 26,7 mil en octubre después de un aumento de 10,1 mil en el mes anterior, cuando se pronosticó un aumento de 30,5 mil. Sin embargo, el cambio en el Índice de Ganancias Promedio (el promedio móvil de 3 meses en comparación con el mismo período del año anterior), que representa el cambio en el precio que las empresas y el gobierno pagan por la mano de obra, incluidas las bonificaciones, aumentó a un ritmo del 4,3% cuando se esperaba un crecimiento menor del 3,9%. Al mismo tiempo, la tasa de desempleo aumentó al 4,3% desde el 4,0/% en septiembre, cuando se pronosticaba un repunte al 4,1%. Un aumento más lento de lo esperado en el número de desempleados en el Reino Unido es alcista para el GBPUSD, mientras que el índice de ganancias promedio más alto y las tasas de desempleo son bajistas para el par. La configuración actual es bajista para el GBPUSD.

Nota:

Este resumen tiene carácter informativo-educativo y se publica de forma gratuita. Todos los datos que contiene este resumen, son obtenidos de fuentes públicas que se consideran más o menos fiables. Además, no hay niguna garantía de que la información sea completa y exacta. En el futuro, los resúmenes no se actualizarán. Toda la información en cada resumen, incluyendo las opiniones, indicadores, gráficos y todo lo demás, se proporciona sólo para la observación y no se considera como un consejo o una recomendación financiera. Todo el texto y cualquier parte suya, así como los gráficos no pueden considerarse como una oferta para realizar alguna transacción con cualquier activo. La compañía IFC Markets y sus empleados en cualquier circunstancia no son responsables de ninguna acción tomada por otra persona durante o después de la observación del resumen.